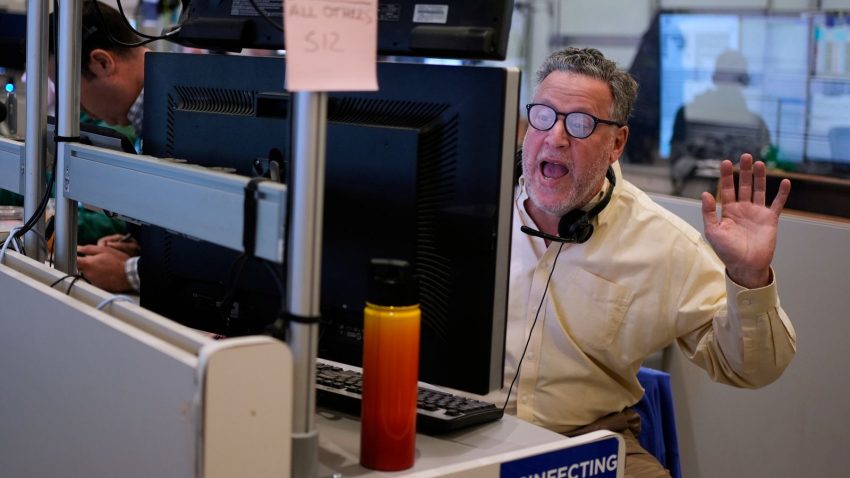

For the second day running, US markets have plummeted in response to the widespread global tariffs Donald Trump announced on Wednesday.

A tariff is effectively a tax on imported goods – the White House believes the US has been on the wrong end of these for decades and Trump claims his hope is that his policy will encourage companies to manufacture inside the US and thus “make America wealthy again”.

But the scale of the US president’s actions has caused chaos in the global economy.

European and Asian markets have suffered notable falls – but the US was worst hit, with Wall Street closing to a sea of red today following yesterday’s rout – the worst day in US markets since the pandemic.

The UK’s leading stock market, the FTSE 100, also suffered its worst daily drop in more than five years, closing 4.95% down, a level not seen since March 2020.

Analysts estimate that around $4.9trn (£3.8trn) has already been wiped off the value of the global stock market since Wednesday evening.

Governments around the world are broadly adopting two approaches – hitting back with counter tariffs, or waiting to see how this settles.

China is in the former camp, today announcing it was responding to Trump’s 34% tariff with its own levy of the same percentage on US imports.

Trump said Beijing had “played it wrong” and “panicked” in its response, but later said he hoped to “continue working in good faith” with the country, adding a deal over TikTok could be a path to relieve tariffs on Beijing.

Watch US correspondents Mark Stone and Martha Kelner discussing all these developments in our latest Trump 100 podcast…